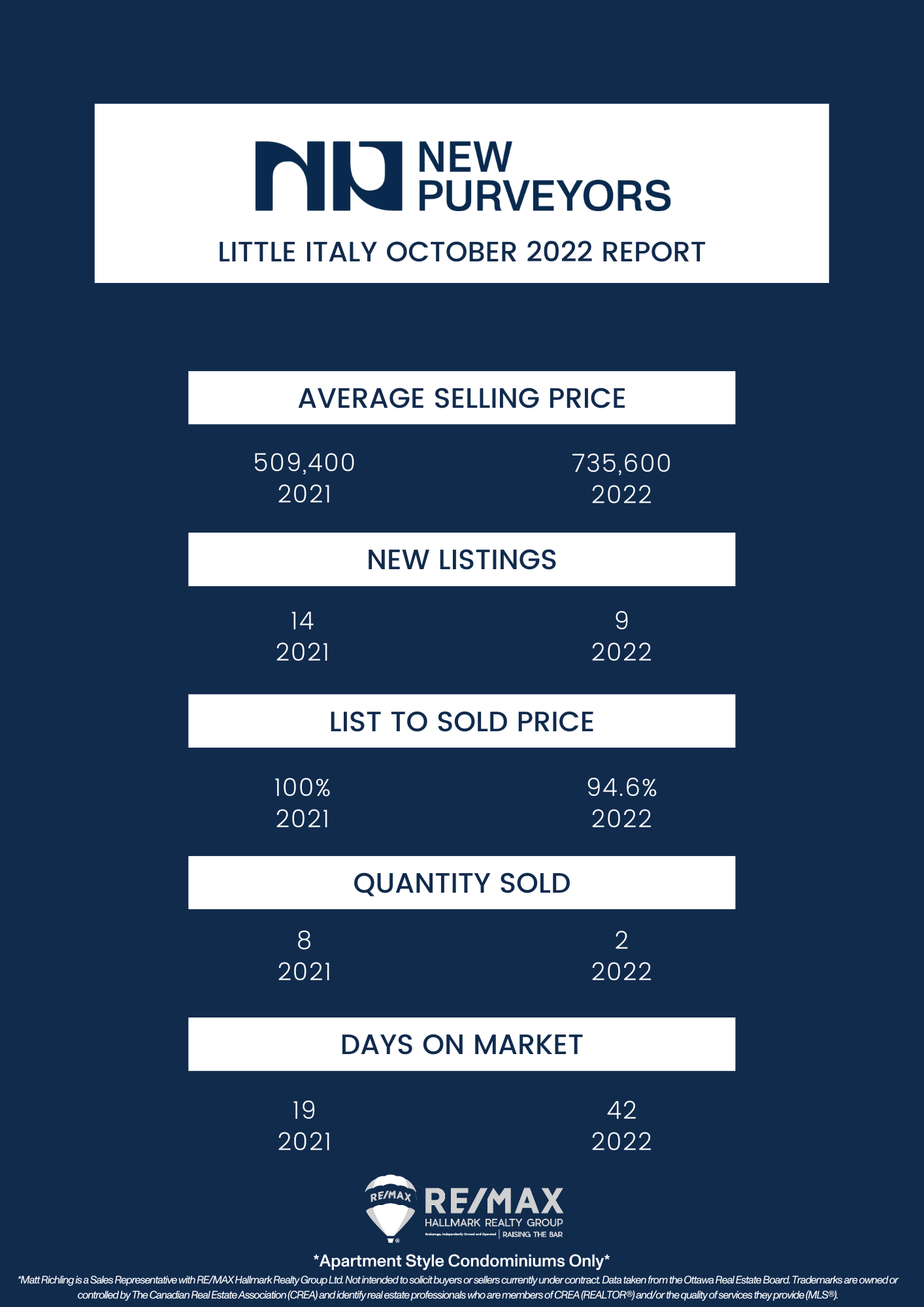

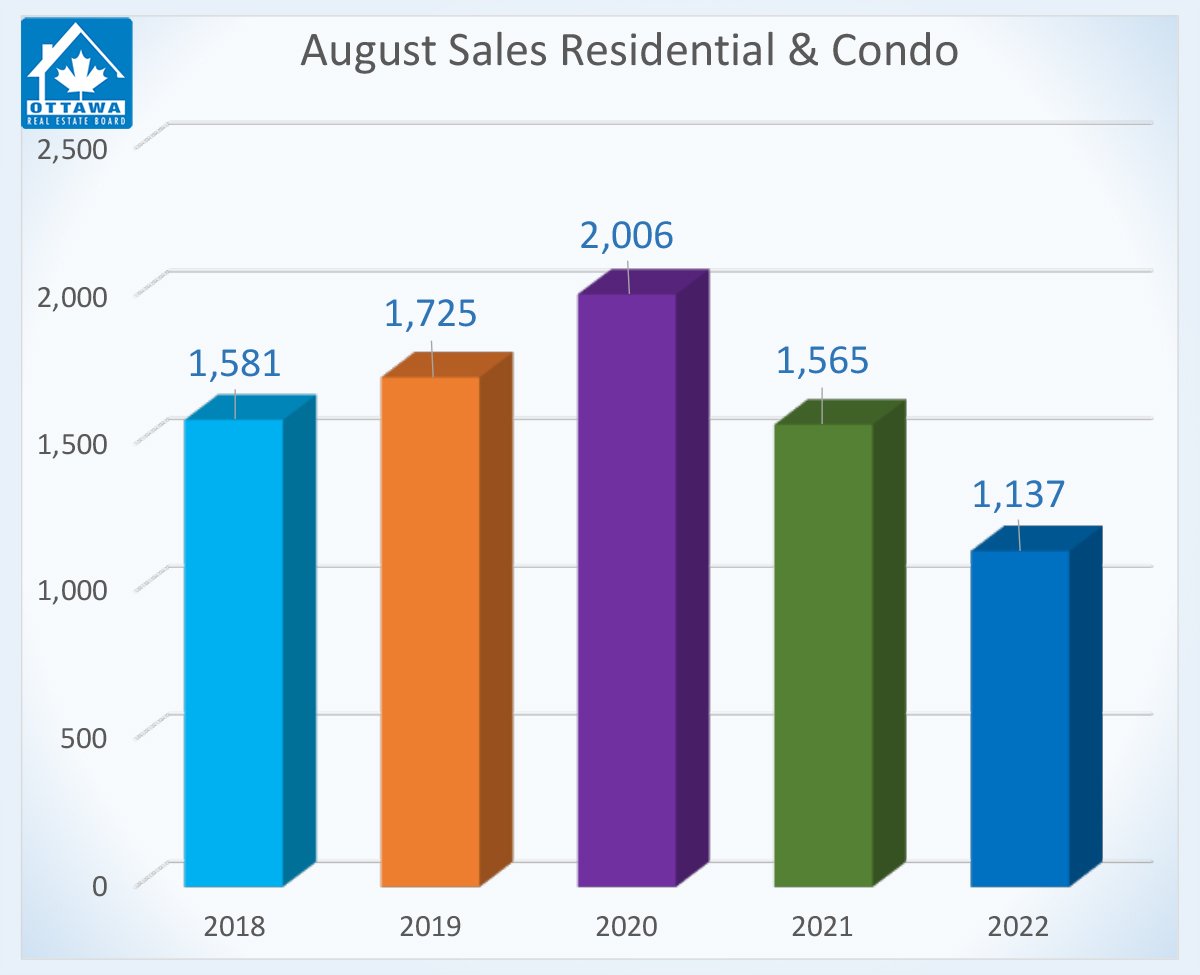

The capital city of Canada is home to a booming real estate market - with a steadily increasing population and a high demand for housing. Despite the recent dip in the market, Ottawa remains a seller’s market with a high level of interest and a low level of inventory.

Ottawa is also a condo-centred city, with tons of options for all lifestyles and budgets. Condos continue to pop up in the city every day, with new projects continually proposed. The demand for easy, downtown living is clearly high here and continues to grow with the population.

Economic Growth

Ottawa has a stable economy and a low unemployment rate, which is always good news for real estate investors. Ottawa has a very diverse economy, with plenty of large sectors in the area including government, tech, healthcare, and education. This stability has contributed to a steady increase in property values and eligible tenants.

High Demand

Ottawa’s population has been steadily increasing over the years, and will continue to do so as Canada and Ontario particularly continue to welcome more people. Condos in particular have become more popular in Ottawa because of their affordability and convenience. Many people in the city are looking for small and affordable living spaces. Furthermore, homes that are close to the action of downtown - whether that be work or shopping, dining, and entertainment. They also fix a lot of the problems that come from Ottawa’s harsh winters. In condos, snow removal is covered by the building, parking is typically inside, and there are often amenity spaces to host friends outside of your home without having to travel.

Rental Market

Another reason Ottawa is a great place for investing in condos is that Ottawa is a major rental city. From a high student and young-professional population, there are plenty of renters in the city who are looking for small, affordable, and temporary properties in the area. Condos, additionally, are an excellent choice for investors anywhere because they offer low-maintenance, turn-key investments that typically bring in more income than residential rentals.

Amenities and Lifestyle

Ottawa is a great city for condo investments too because of the amenities and lifestyle that are offered in so many of these buildings. Condos not only reduce a lot of the maintenance and housework that can be a deterrent for renters (like shovelling snow, parking outside, gardening, and more), but they also offer a lot of great options to replace what a condo unit may lack compared to a residential home. Condos often have party rooms, pools and hot tubs, and gyms - meaning residents don’t have to leave the comfort of their homes to host parties, swim or relax, or workout. All of these lifestyle additions are a huge attraction for tenants.