Are you looking to rent out your Ottawa condo, but don’t know where to start? Heard too many horror stories about bad tenants? We have put together a short guide to help guide you with the leasing process and what to expect.

Know Your Condo

Gather all of the information that you can. Ask your condo board about the rules or restrictions on rentals. Some buildings in Ottawa have minimum lease length of three or six months (to stop short term leasing), and some have rules stating that all tenants must be from the same family (to avoid student or rooming homes). What utilities or services are included in the rent or in the condo fee? What about pet’s? Etc. The more information that you can find out, the easier it will be down the line.

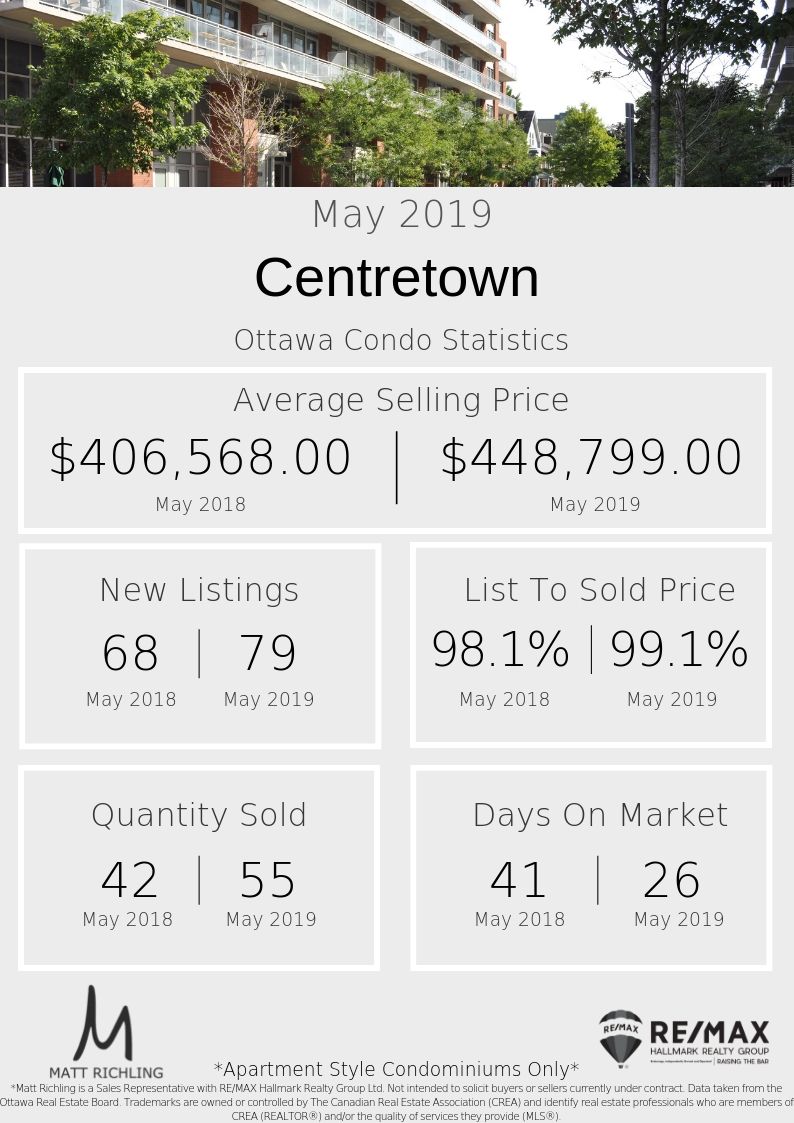

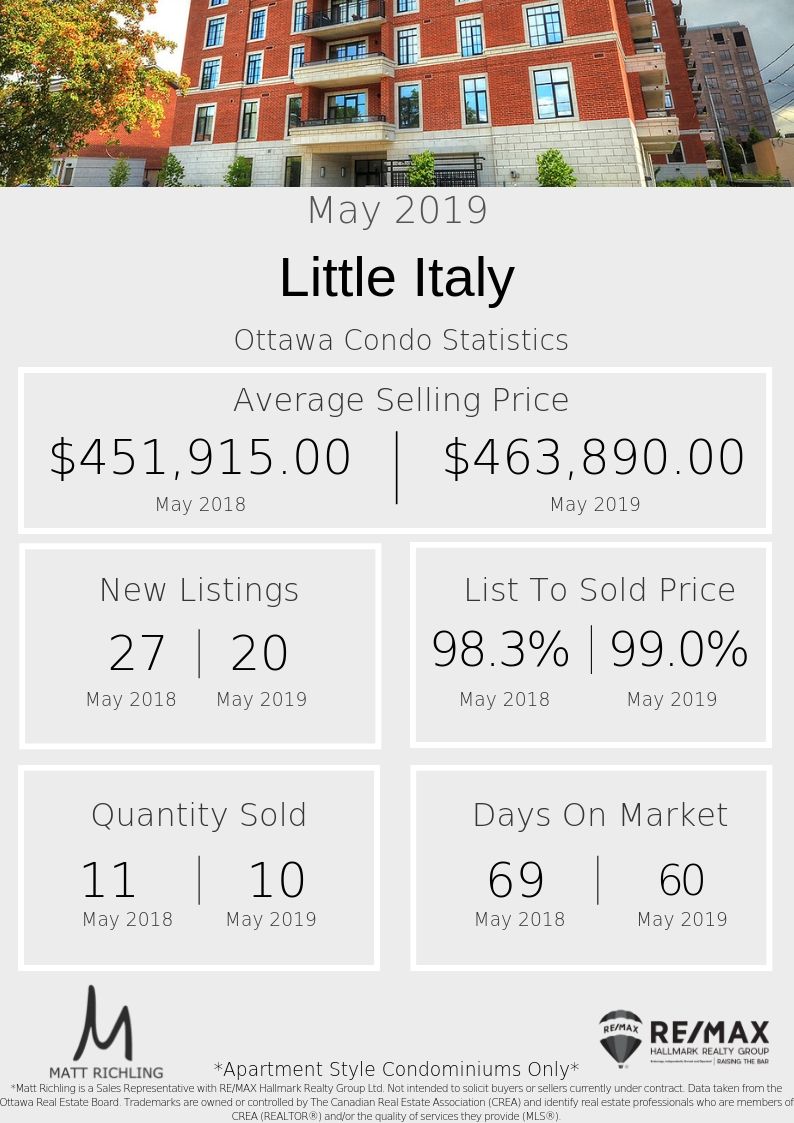

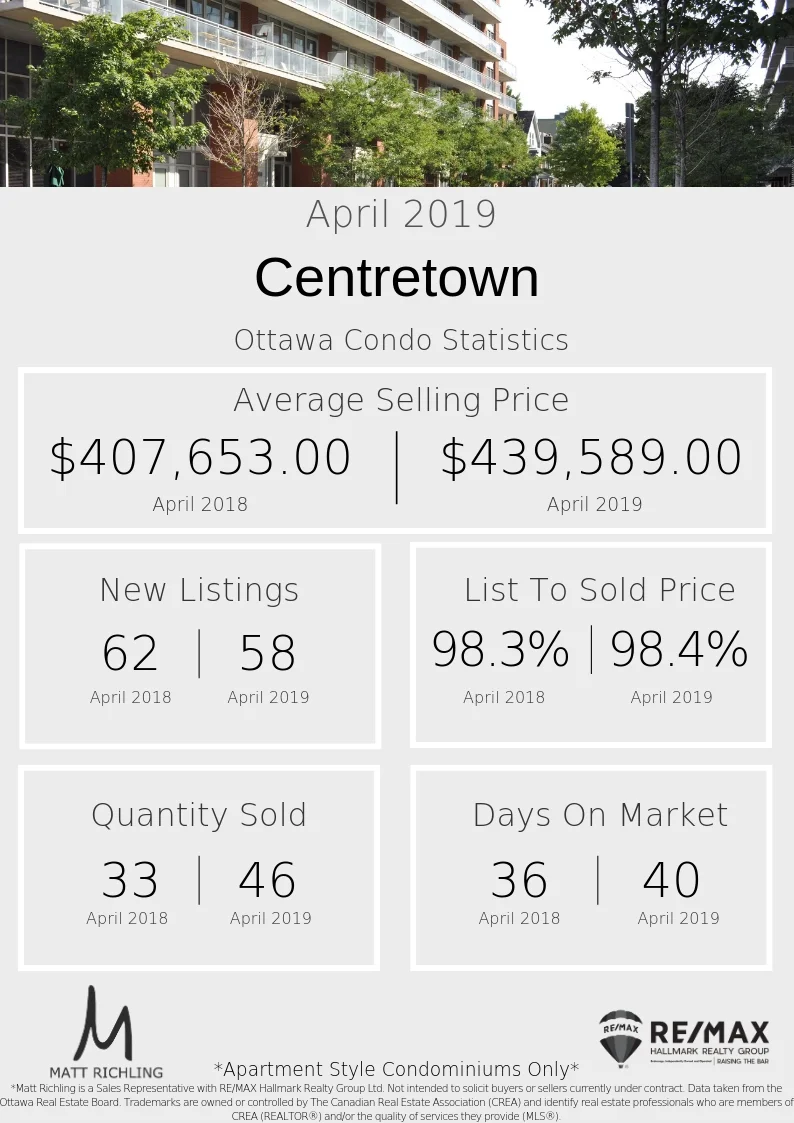

Know Your Market

How much are you going to price the condo for? What are rentals going for in your building or area? How do they compare to your unit? What is the market like and can you take advantage of that? Are you looking to rent the unit furnished? We have seen prices jump around $200 per month this year depending on the building and location, due to a lack of inventory.

Marketing

Before we can get tenants into the property we need marketing materials (pretty pictures) that help gather interest. Is the unit vacant or do you still have your furniture in the unit? If you are still there, do you need to declutter and do any repairs or remove furniture? We almost need to treat it like you are selling. Remember we are trying to find a tenant who is going to love the place as much as you do and one who is willing to pay top dollar for that space.

Once everything is perfect we bring in our professional photographer to capture the unit. While you might think it is easy to rent with basic phone quality shots, or even no photos (depending on how hot the market is), having back up photos when the place looked perfect is invaluable. The tenants might not leave it the cleanest and to have the photos ahead of time is only going to save you in the long run!

Best Places To Advertise The Rental In Ottawa

Same as when you are selling, you want to get the maximum exposure that is possible. Industry websites like Realtor.ca are mandatory, but still important are Kijiji, Craigslist, Padmapper, Zumper, along with the more local sites! Are you targeting a specific tenant, such as a student (Ottawa or Carleton University), or diplomat or even specific embassy, political member or specific party, high tech crowd? Depending on the tenant there are specific websites that would be a better target for that tenant. To advertise to Carleton University students, we use Places4Students.com as it is the preferred vendor by the school.

Writing the Ad

Thinking like the tenant you are trying to attract and writing the ad to speak directly to them. Focus on facts and information, not fluff. Know your rules and listing off what is included in the rent. Things that might seem obvious to you, might not be to a tenant. Be clear and don’t use all caps (unless you

Showings and Inquires

Once the property ad goes live, you will start to get inquiries from interested tenants. Often they want some clarification about the ad (is “X” allowed, or is “Y” included in the rent?). Use these questions to help improve the ad if you are not getting the responses that you are expecting. The majority of the inquires will want to book a showing to see the unit. In a hot market, you can schedule a few times that work best for you. Make sure that when you are booking a showing you get some basic information about the person and what they are expecting (when do they want to start etc) so you are not wasting your time if that isn’t possible. Qualifying them as best as possible.

Tenant Selection

Once you have started getting tenants interested in applying, then you really need to put on your detective hat. We have all prospective tenants fill out a full rental application, which lists current and previous job and housing situations. It asks for references, about pets, expected start date, car information, and debts. We will also ask for proof of employment (such as pay stubs or letter of employment), plus we will pull there credit report (equifax etc) so we can see first hand their credit score and how they have managed their finances. We are trying to paint a picture of who the tenant is, and how reliable they will be. Once you have collected all of this, then call the references and employer and verify things that are on the application. You want to ensure they have not lied! Be careful when calling current landlords, often they will say amazing things about the tenant in order to get them out - helping problem tenants find a new place to call home! When speaking to landlords, ask facts, such as did they pay rent on time, etc.

The Lease

Once you have selected a tenant, you will need to have them sign the lease! The government has made this much easier with introducing the mandatory residential lease. It is quite easy to fill out, but take your time and ensure you fully understand each part of the lease. Just because you can cross something out or add a special clause does not mean it is legal or enforceable. You can always speak with your lawyer to help with any additional clauses or questions!

TIPS for condo landlords!

Don’t forget to change your insurance to landlord insurance! Plus make sure your tenants have property and liability insurance as well!

Often utility companies have Landlord accounts, so any days in between tenants are properly charged to you.

Be upfront with your tenants. We prefer open dialogue and good communication with our tenants. If you don’t want pets, make it clear in the add and tell those who apply.

Learn the rules, and don’t be afraid to ask questions if you are unsure.

It’s a business - so treat it like one. Keep a record of all of your expenses. Speak with an accountant. You can’t write off your time!

Explore the benefits of hiring a property manager. A great property manager is worth their weight in gold.

Questions about renting out your condo? Want help and guidance? Let’s chat!