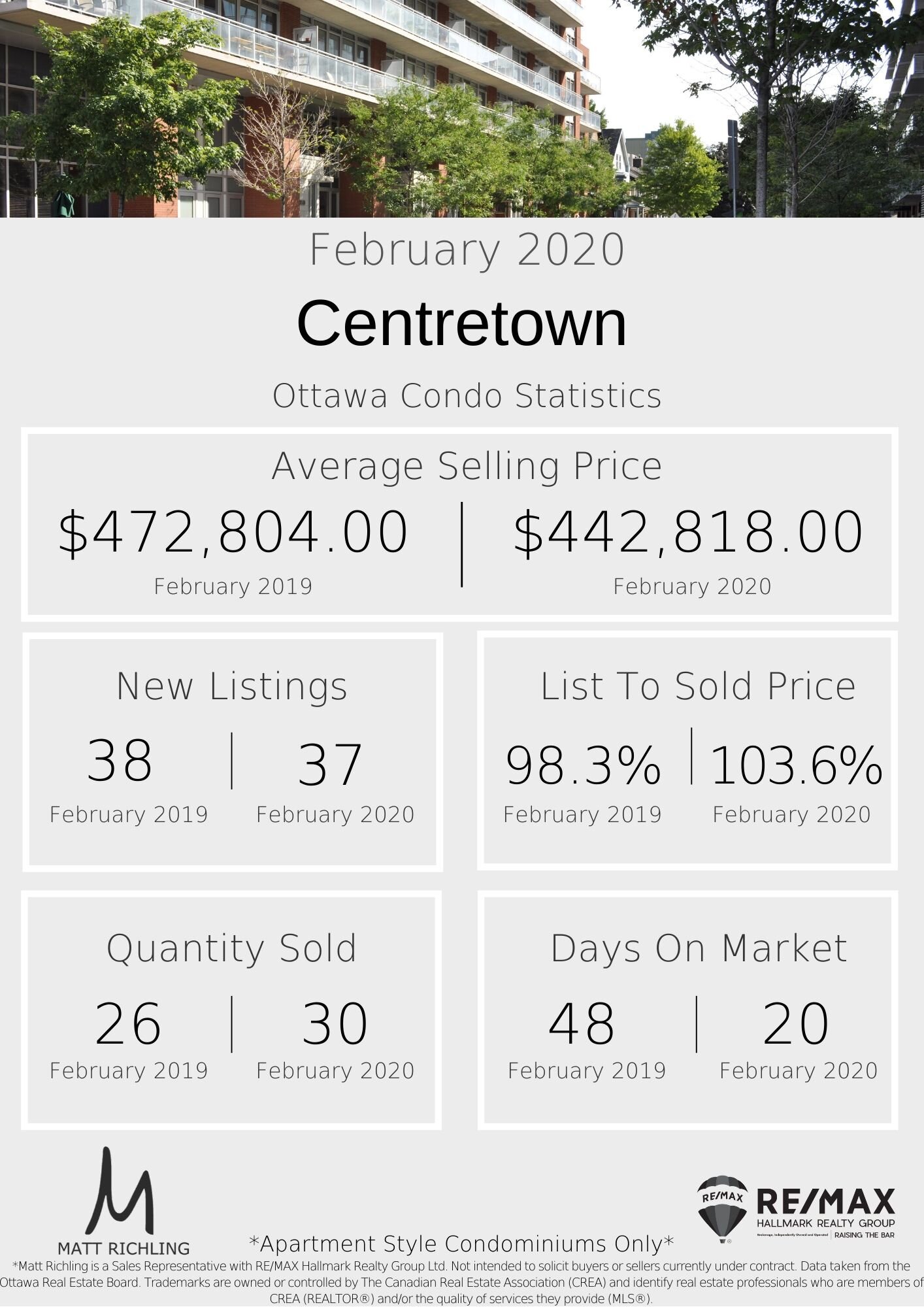

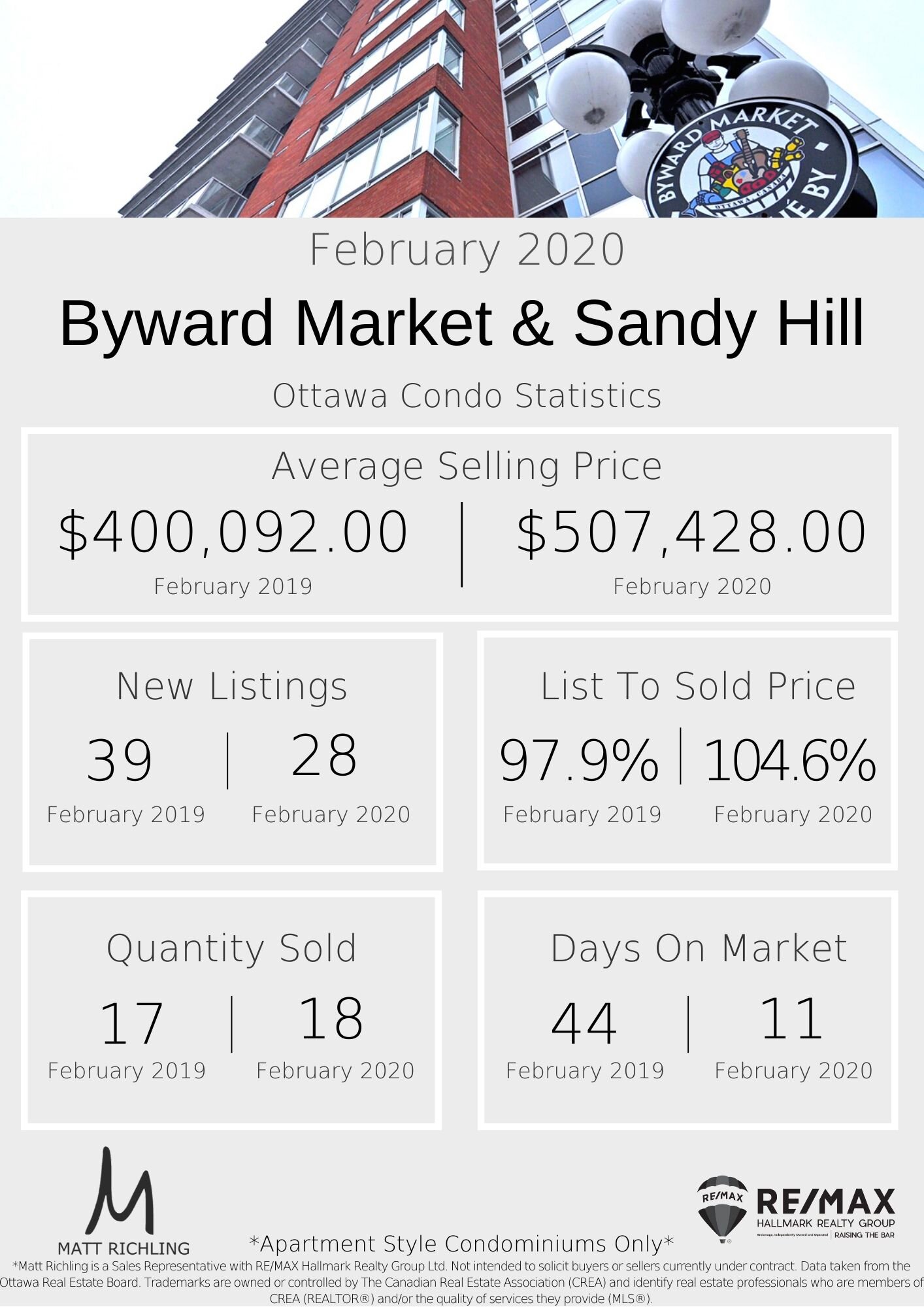

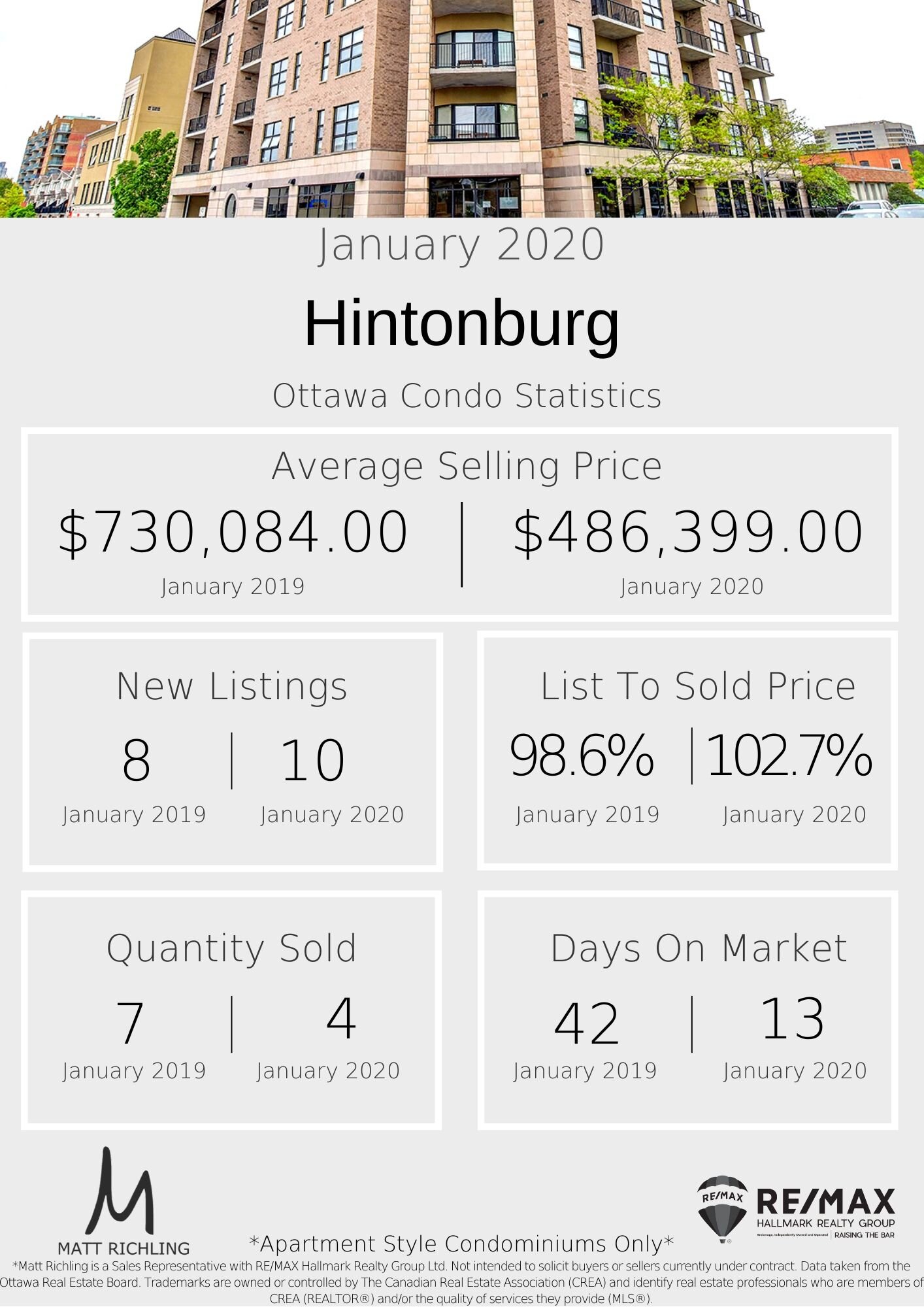

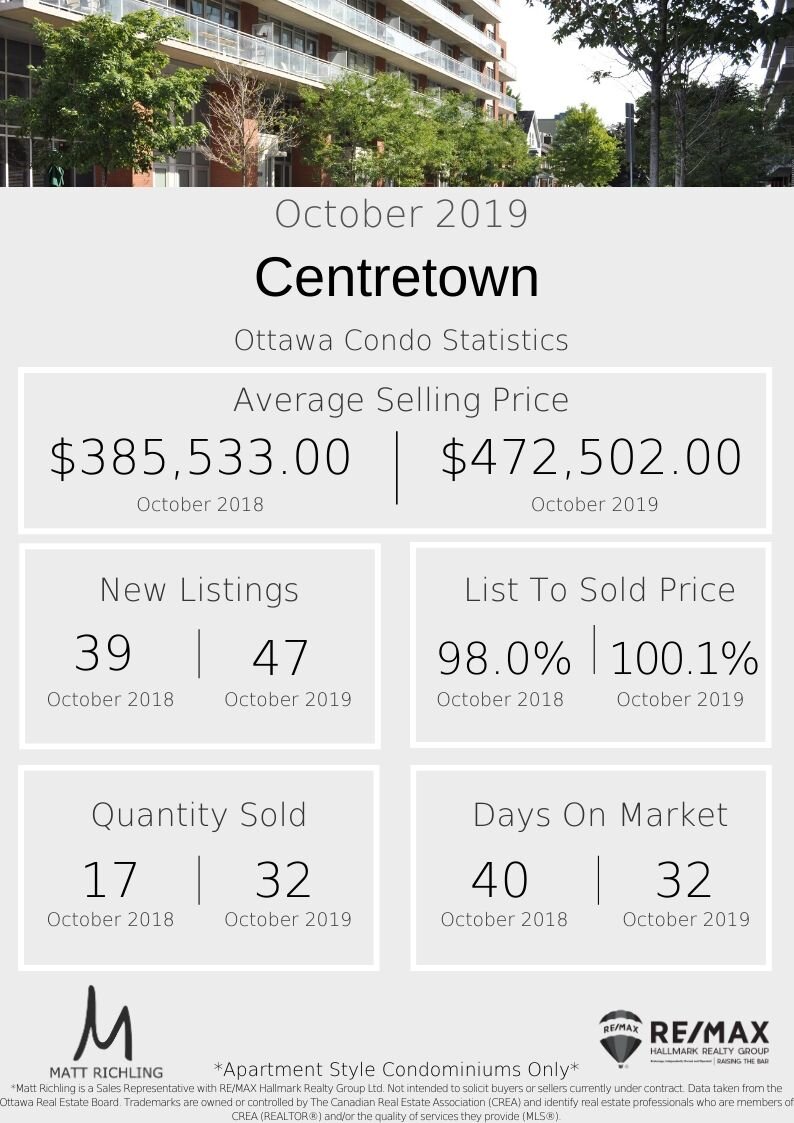

Every month we take a closer look and drill down the sales data of Ottawa condos from the previous month. Here are the statistics for February 2020 in the top five "downtown" areas - Centretown, Byward Market and Sandyhill, Little Italy (which includes Lebreton Flats), Hintonburg, and Westboro. The information will be specific to apartment-style condominiums, and only what sold through the MLS. Also important to note that DOM (Day's On Market) is calculated to include the conditional period, which in Ottawa is almost every single transaction to be roughly 14 days.

There is not much more I can say that anyone who is active in the market doesn’t already know. It is hard out there for a P.I.M. errr… buyer. We are seeing almost every condo now being listed with a date that they will accept offers on. Very few are selling below asking, which also means very few are selling with conditions - just look at the different DOMs below - 11 days on market in Byward/Sandy Hill, which is down from 44 days on market last year (again, this number includes the conditional period if there is one). We are coaching our buyers to have all of there ducks in a row before the process. If the property you are offering on is in multiple offers, let’s get as much of the conditional period done BEFORE putting in an offer. We have a team of lawyers who can provide a status certificate review within 2-3 hours (I had one last week that I sent at 4:20 pm on Friday evening, and it was back just before they left at 5 pm - AMAZING, and put my clients way ahead of the competition). We have the tools and experience to give you the advantage over other buyers and to help get you the property.

Sellers - if you are thinking about selling anytime in the next year, now is the time to start the plan. We are doing four or even six month plans right now in order to get the property in its best shape and position so that when the time comes, we can maximize the return and remove as much of the uncertainty as possible. This is especially important if the property is tenant occupied, or if the tenants have not yet given their notice. We can easily see the properties that had a plan, and ones that were “thrown together” last minute.

Want to chat about your options? Fill out the form at the bottom of the page, or call me directly 613-286-9501.

Do you have any questions about how this information affects your investment or looking for more information to make the best decision about your purchase? Let’s chat! Fill out the form on the bottom of the page.