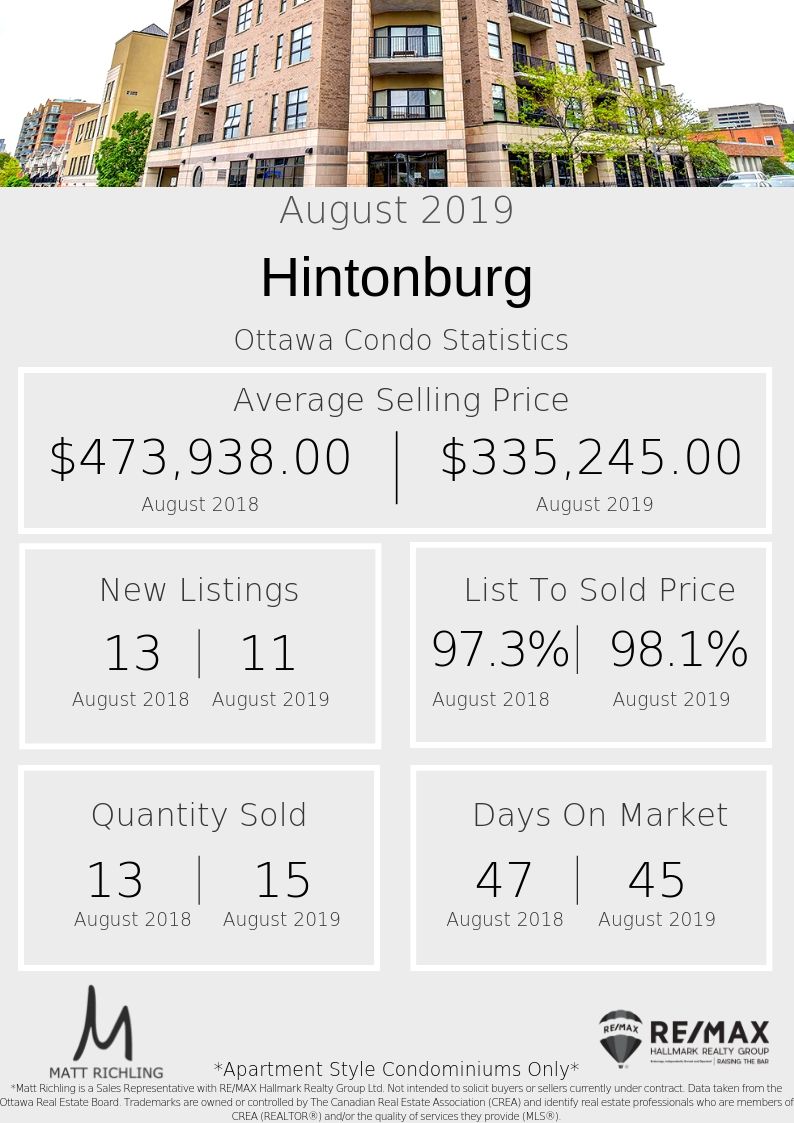

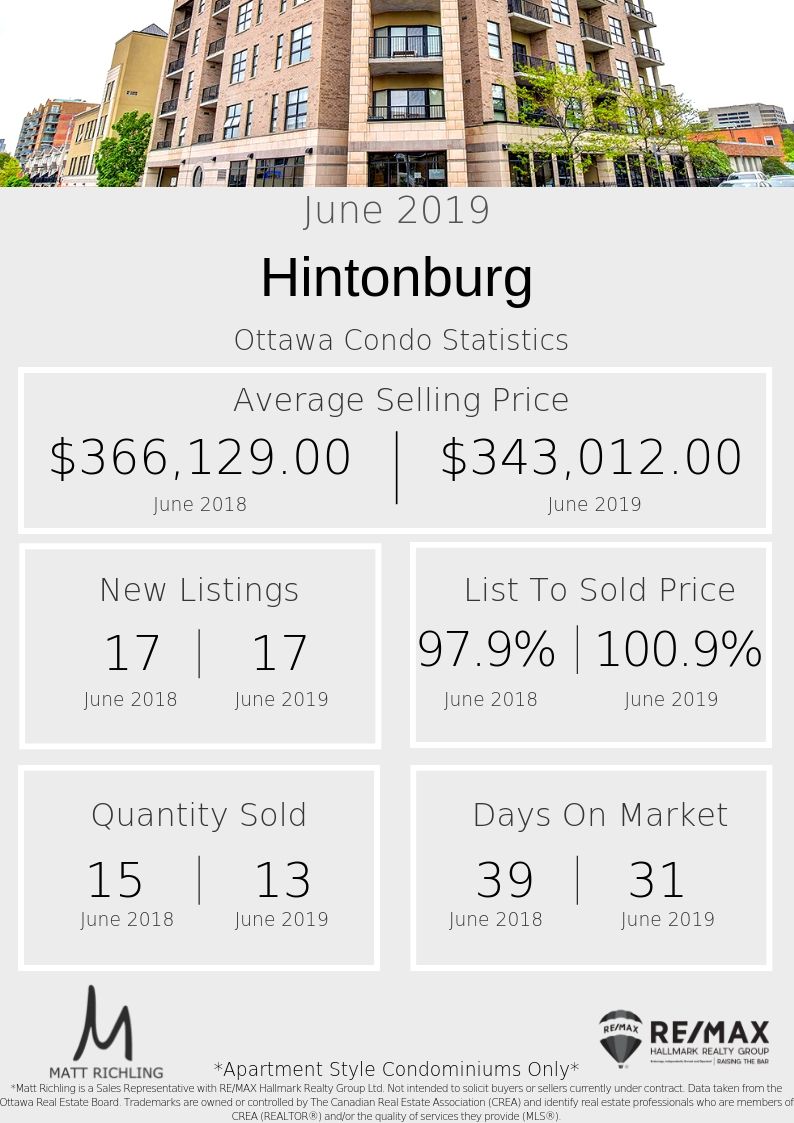

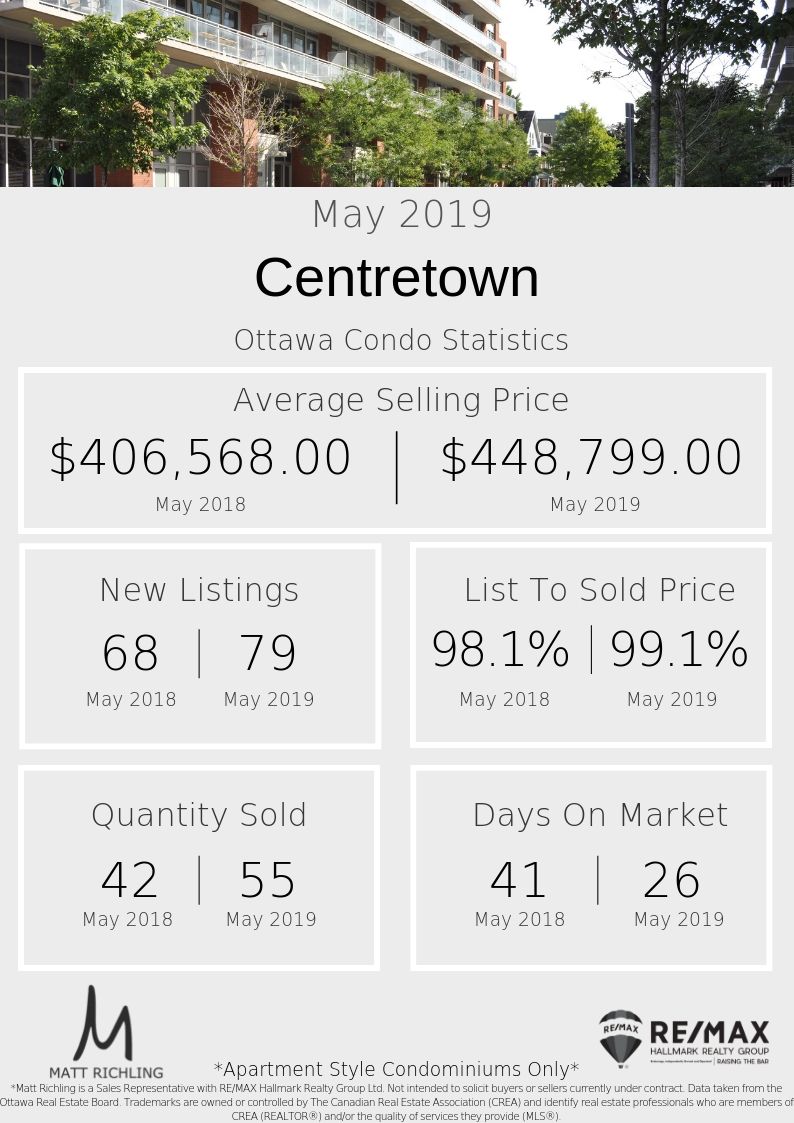

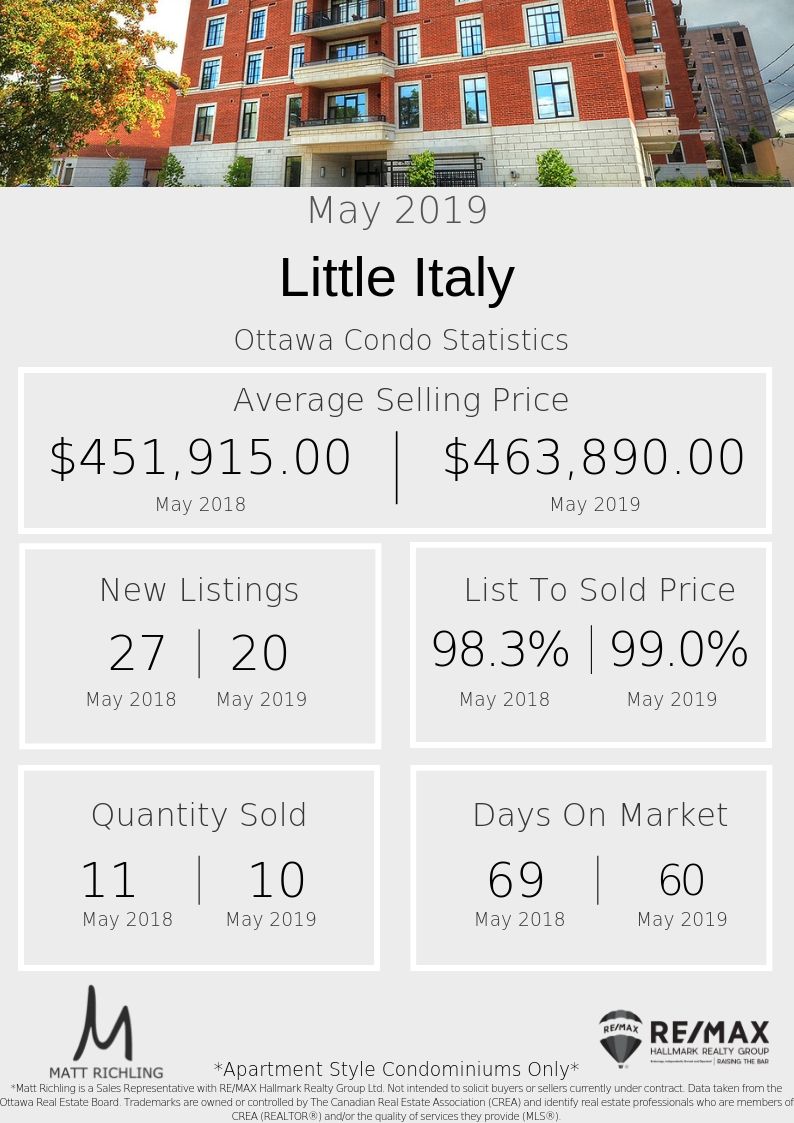

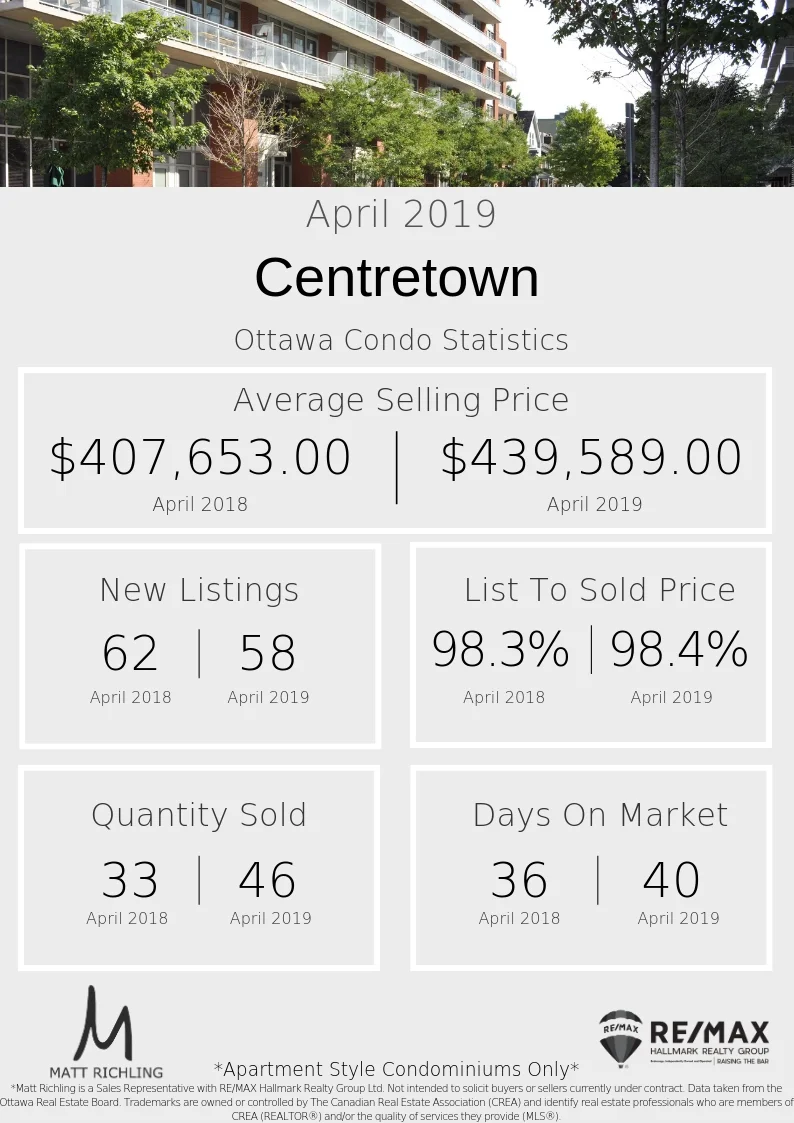

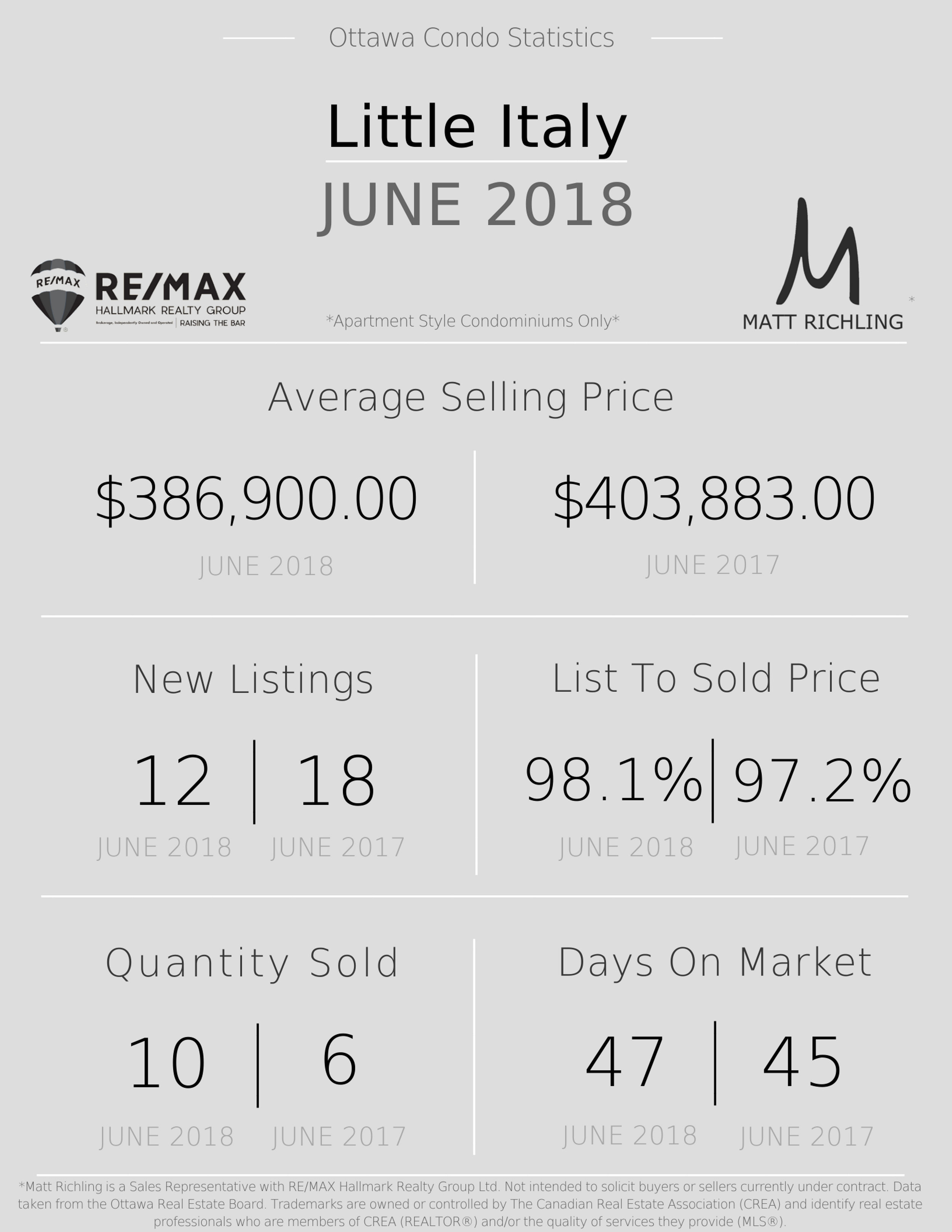

Every month we take a closer look and drill down the sales data of Ottawa condos from the previous month. Here are the statistics for August and the top five "downtown" area's - Centretown, Byward Market and Sandyhill, Little Italy (which includes Lebreton Flats), Hintonburg, and Westboro. The information will be specific to apartment style condominiums, and only what sold through the MLS. Also, DOM (Day's On Market) is calculated to include the conditional period, which in Ottawa is almost every single transaction to be roughly 14 days.

August was another busy month for condo sales in some neighbourhoods. We saw a large increase of parents coming purchasing units for their kids who are attending University. With the average rental prices jumping in the downtown core, more parents are looking at purchasing a unit as more attractive option. This fuelled the high number of sales in Centretown and Byward Market/Sandy Hill (86 sales in total). Centretown had a significant increase in average sold price, which was due to five units selling over the one million price point. Almost every neighbourhood had more units sell than new units that were listed.

If you are buying, there are still some great deals that we are seeing. Stuff that has sat on the market and not sold in multiple offers, that could be picked up at a decent price and on your terms. However if you are looking for that premium view, extra large, A++ unit, then don’t wait - pay a little extra now because everyone wants the same unit as you. Especially if you are looking at properties that fall within the First Time Home Buyers Incentive range.

If you are selling, we are placing a high importance on getting the correct pricing and spending extra time to prepare the condo for showings. Things that show well and are priced right, do not last in this market and sell for top dollar (often with multiple offers). The fall market is now here and we are expecting a hotter fall then we experienced in 2018. Especially now with the First Time Home Buyers Incentive, which will push more buyers into the market.

Do you have any questions about how this information affects your investment or looking for more information to make the best decision about your purchase? Let’s chat! Fill out the form on the bottom of the page.